by Adam Quigley, Founder & CEO The Events Consultant

As we move into 2025, the events industry is facing both challenges and opportunities. The latest data from Venue Directory offers an in-depth look at how the industry is evolving. Below is a comprehensive analysis of these trends, with a focus on the implications for event organisers and venues.

1. Overall Trends in Enquiries and Bookings

Total Enquiries and RFP Value

The data reveals a mixed picture for 2024: While the number of enquiries has decreased, the value of those enquiries has increased slightly.

- Total Enquiries for 2024 are 186,724, representing a 4% decrease compared to 2023. This continued decline in enquiries highlights a potential slowdown in demand across the industry.

- Despite the fall in enquiries, the RFP (Request for Proposal) Value has increased by 2%, reaching £666,721,431 in 2024. This represents a slight increase from £654,505,244 in 2023, showing that while fewer enquiries are being made, those that are submitted are often for larger and more lucrative events.

Enquiry Breakdown Over Time

| Year | Total Enquiries | Enquiries Change (%) |

| 2019 | 300,527 | — |

| 2020 | 97,892 | -67% |

| 2021 | 97,938 | 0% |

| 2022 | 178,361 | +82% |

| 2023 | 195,321 | +10% |

| 2024 | 186,724 | -4% |

Looking at the Total Enquiries over the past six years, we can identify several key patterns:

- 2019:The year started with a strong performance, recording 300,527 total enquiries. This marks the baseline from which subsequent trends can be measured.

- 2020:The sharp decline to 97,892 enquiries (a 67% decrease) clearly reflects the significant impact of the COVID-19 pandemic. Events were heavily restricted, and venues faced long closures, contributing to a large fall in demand.

- 2021:The number of enquiries remained relatively flat, with only a slight increase to 97,938, essentially a 0% change from 2020. Despite the pandemic easing, the event industry was still adjusting to new conditions, and many events were either cancelled or postponed.

- 2022:A remarkable 82% increase occurred in 2022, with 178,361 total enquiries. This resurgence is likely attributed to the lifting of restrictions and a return to in-person events. Venues and organisers began to ramp up their event schedules, leading to a strong rebound.

- 2023:The number of enquiries rose modestly by 10%, reaching 195,321. While this is a positive year-on-year increase, the growth rate slowed compared to the sharp rebound in 2022. This suggests the market was stabilising after the pandemic and potentially facing new challenges, such as inflation or rising costs.

- 2024:The most recent data shows a 4% decline in total enquiries, with 186,724 total enquiries recorded. This marks the first decrease after a steady recovery from the pandemic, possibly reflecting a more cautious outlook from organisers due to economic uncertainty or other market factors.

RFP Value Breakdown Over Time

| Year | RFP Value (£) | RFP Change (%) |

| 2019 | £493,329,125 | — |

| 2020 | £269,875,328 | -45% |

| 2021 | £402,101,600 | +49% |

| 2022 | £1,014,607,556 | +152% |

| 2023 | £654,505,244 | -35% |

| 2024 | £666,721,431 | +2% |

Analysis: While 2023 saw a significant decline in RFP value, the slight recovery in 2024 suggests that event planners may be focusing on fewer but more substantial events. The year-on-year fluctuations demonstrate an industry adjusting to economic factors, possibly influenced by tighter budgets or changes in event formats.

2. Event Booking Trends: Days of the Week

A notable shift in the most popular days to book events has occurred. Wednesday now tops the list, with 25% of bookings, narrowly beating Thursday at 24%. This is a shift from previous years when Thursday was traditionally the most popular.

Event Booking Days Breakdown

| Day | Bookings (%) |

| Monday | 11% |

| Tuesday | 23% |

| Wednesday | 25% |

| Thursday | 24% |

| Friday | 9% |

| Saturday | 5% |

| Sunday | 3% |

Analysis: The rise in mid-week events, particularly on Wednesday, suggests a shift in the working habits of event organisers, with more companies opting to schedule events outside the traditional Thursday timeframe. For venues, this shift in booking preferences may require them to adjust their availability and pricing structures for mid-week events.

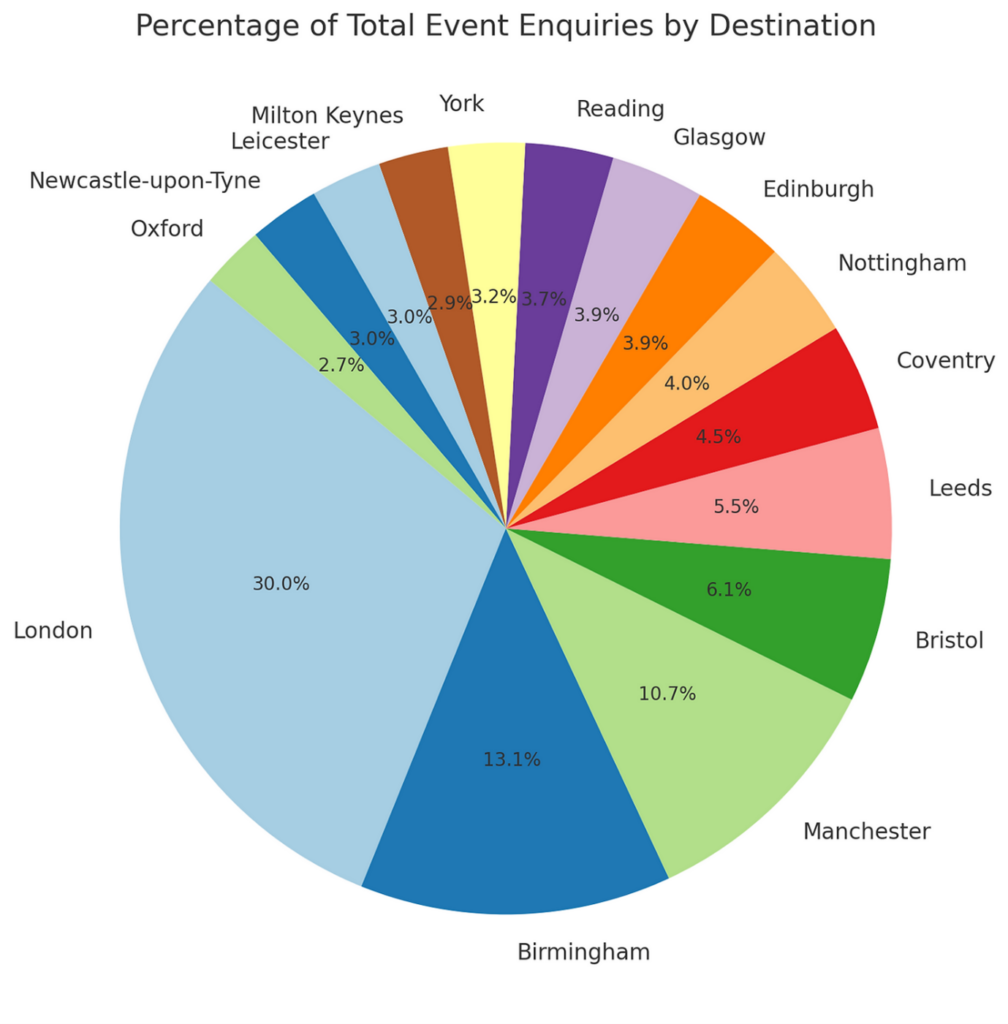

3. Shifting Event Destinations: Regional Changes

While London remains the most popular destination for events, we’ve seen some interesting changes in the regional market. Liverpool has dropped out of the top 15 UK destinations, likely due to rising event costs in the city. As a result, event organisers are looking for more competitive options elsewhere.

Top 15 UK Event Destinations in 2024

| Destination | Enquiries | % of Total Business |

| London | 31,968 | 30.00% |

| Birmingham | 13,911 | 13.05% |

| Manchester | 11,447 | 10.74% |

| Bristol | 6,452 | 6.05% |

| Leeds | 5,813 | 5.46% |

| Coventry | 4,783 | 4.49% |

| Nottingham | 4,303 | 4.04% |

| Edinburgh | 4,149 | 3.89% |

| Glasgow | 4,140 | 3.89% |

| Reading | 3,932 | 3.69% |

| York | 3,420 | 3.21% |

| Milton Keynes | 3,116 | 2.92% |

| Leicester | 3,157 | 2.96% |

| Newcastle-upon-Tyne | 3,147 | 2.95% |

| Oxford | 2,824 | 2.65% |

Analysis: London still dominates as the preferred destination, but other cities like Birmingham and Manchester continue to grow in popularity. Interestingly, Liverpool’s exclusion from the top 15 highlights the impact of rising costs on event bookings, which is pushing organisers to seek more affordable options.

4. The Changing Average Booking Window

In 2024, the average booking window has increased slightly, from 10 weeks in 2023 to 11 weeks in 2024. This shift indicates that event organisers are planning further in advance, possibly due to the complexity of event logistics, larger guest lists, or the need for more time to secure venues.

Analysis: Venues should expect more long-term planning in 2024. As the average lead time increases, this may provide venues with a better opportunity to secure bookings and manage schedules more effectively.

Conclusion on Event Industry Trends

Key Takeaways from the Data

As we look at the data for 2024, several key event industry trends are emerging that event professionals and venues should consider. While the overall number of enquiries has decreased, the RFP value has increased, indicating that organisers are focusing on larger and more lucrative events. The shift in booking patterns, with mid-week days becoming more popular and regional cities adjusting to rising costs, shows that the industry is evolving.

- Post-Pandemic Recovery: The most significant trend is the recovery following the pandemic, seen in the sharp 82% increase in 2022. While the industry had a slow start in 2021, it surged back strongly, showing the resilience of the events sector.

- Modest Growth in 2023: The growth in 2023 was smaller than in 2022, suggesting that the event industry had returned to a state of normalcy, but the huge gains from the pandemic rebound were unlikely to continue. Smaller incremental growth may be the new norm, as event organisers face a post-pandemic world that requires more thoughtful planning and consideration.

- A Decline in 2024: The 4% decline in 2024 could be a result of several factors, including economic uncertainty, increased event costs, and changing event preferences. The trend towards smaller, regional, or hybrid events may also be contributing to the slower rate of enquiries.

- The Role of Technology and Hybrid Working: Another factor worth considering is the continued shift towards hybrid working, combining in-person and virtual components. While some parts of the market are still embracing traditional in-person events, the rise of digital technology means organisers can now reach a broader audience without the same costs associated with physical events. This shift could also affect the volume of physical event bookings.

- Economic Pressures: The decline in enquiries in 2024 suggests that economic pressures, such as inflation, rising costs, and budget constraints, may be impacting event organisers’ ability to commit to large-scale events. The uncertainty in the global economy may be leading to more cautious event planning.

Between 2019 and 2024, the UK experienced a total inflation rate of 23.9%, significantly impacting real-term value comparisons. In 2019, the total enquiry value for events was £493,329,125. Adjusted for inflation, this equates to £611,234,786 in today’s terms. In comparison, the 2024 enquiry value stood at £666,721,431, representing a real-term increase of approximately 9.08%. This growth highlights a significant improvement in the value of enquiries over the period, despite economic challenges such as inflation, global supply chain disruptions, and rising costs of goods and services.

| Year | Enquiry Value (£) | Number of Enquiries | Average Value (£) | Adjusted Enquiry Value (£) | Adjusted Average Value (£) |

| 2019 | £493,329,125.00 | 300,528 | £1,641.54 | £611,234,785.88 | £2,033.87 |

| 2024 | £666,721,431.00 | 186,724 | £3,570.63 | £666,721,431.00 | £3,570.63 |

For venues, this means that being flexible with event days, maintaining competitive pricing, and focusing on longer-term planning will be essential in staying ahead. Event professionals, on the other hand, should be prepared for a market where quality over quantity is becoming the focus, and planning ahead will be more crucial than ever.

By keeping a close eye on these trends, venues and event organisers can ensure they are well-positioned to meet the demands of the evolving market in 2025.